FINANCIAL SERVICES

OUR SERVICES

We can offer you a wide range of insurance and investment products and services that can benefit your financial situation. Our services range from start-up saving plans to advanced wealth management and estate planning solutions.

WHAT TO EXPECT WHEN WORKING WITH US

We begin with a no obligation consultation where we’ll take the time to listen and get to know what’s important to you. Upfront and approachable, we’ll provide total transparency about fees and process. We’ll use simple language to explain options and recommendations.

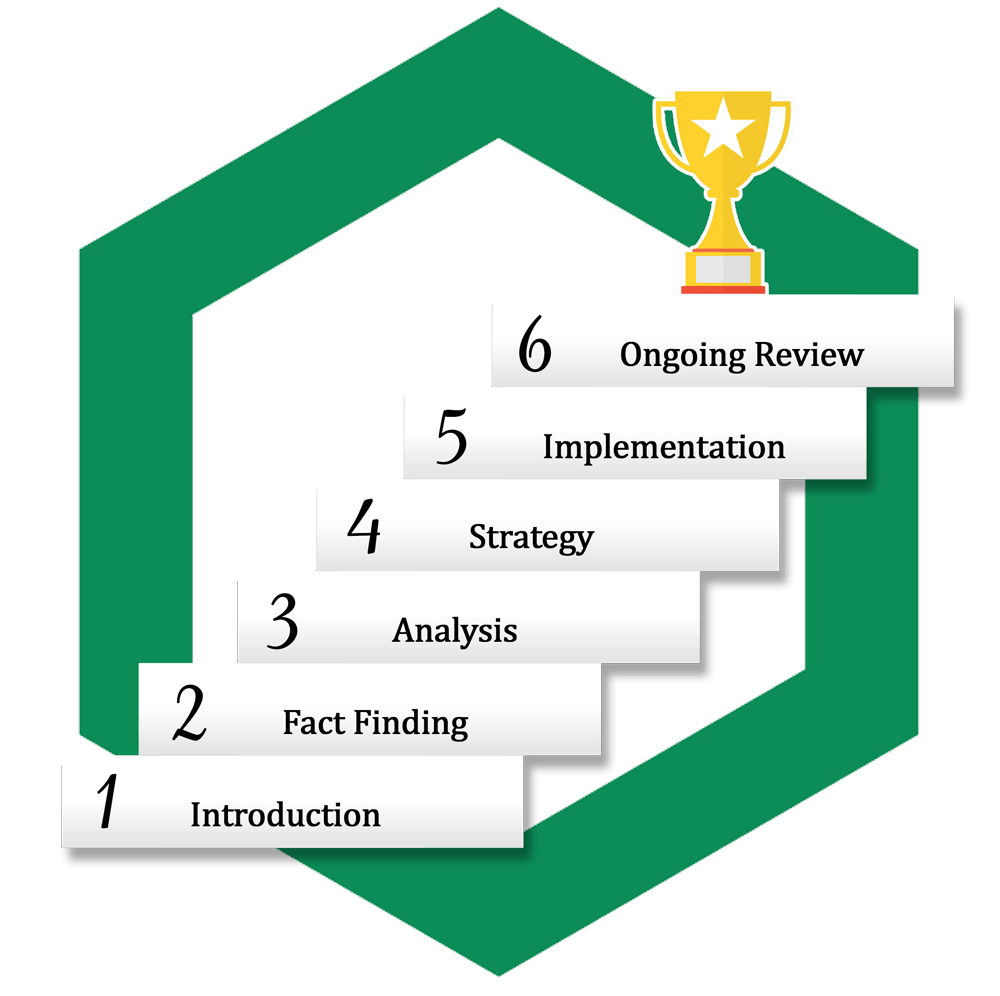

Our Process

- Introduction:

We’ll discuss time-frames, a full disclosure of fees and compensation and responsibilities.

- Fact Finding:

I’ll listen to understand your needs and goals and ask questions to collect information.

- Analysis:

I’ll take away the information and conduct a full analysis, research solutions and create recommendations and a strategy.

- Develop and Present Strategies:

We’ll meet again to explain recommendations and strategies to find your comfort level to move forward.

- Implementation of Financial Strategies:

I’ll put the strategies into motion in the time-frames we’ve agreed upon.

- Ongoing Review of Strategies:

We schedule future touch points where we’ll meet to review and ensure that strategies and results are on target.

Contact us today for your no obligation financial consultation.